Global deforestation has accelerated in recent decades, driving biodiversity loss, climate change, and human rights concerns. According to the FAO, more than 10 million hectares of forest are lost each year worldwide. In response, the European Union introduced the EU Deforestation Regulation (EUDR), a groundbreaking law that directly links market access with sustainable supply chains. This regulation will not only reshape global trade but also impose strict compliance requirements on businesses importing or exporting commodities linked to deforestation.

What is the EU Deforestation Regulation?

The EU Deforestation Regulation (EUDR) is a legally binding instrument adopted by the European Parliament and the Council of the EU to curb global deforestation driven by EU consumption. Replacing the previous EU Timber Regulation (EUTR), this new law goes far beyond timber, expanding its scope and strengthening due diligence requirements.

The EUDR requires companies to demonstrate that their products:

- Are not linked to deforestation (legal or illegal),

- Were produced in compliance with the laws of the country of origin,

- Are traceable to the plot of land where they were grown or harvested.

These obligations are enforced through a due diligence framework, meaning businesses must assess and mitigate deforestation risks before placing products on the EU market.

The regulation’s emphasis is clear: the burden of proof lies with importers, manufacturers, and traders.

EUDR’s Approach to “Deforestation‑Free”

“EUDR‑compliant” means the product is derived from land that has not undergone deforestation or degradation after a specified cut‑off date, is legally sourced, and confirms traceability to the point of origin. In short: No surprises, no secret sourcing, just clarity.

Why Was the EUDR Introduced? Global Context and Urgency

The EU introduced EUDR to curb its contribution to global deforestation and biodiversity loss—a major driver of climate change. Consumption of commodities like soy, palm oil, and timber has been linked to expansive forest loss globally. The EU aims to halve these impacts by enforcing sustainable sourcing practices

By mandating deforestation-free supply chains, EUDR aligns with broader EU strategies such as the European Green Deal, Biodiversity Strategy, and Farm to Fork initiative. It also represents one of the strongest demand-side environmental regulations worldwide

Primary Objectives of the EUDR

This regulatory powerhouse has several intertwined goals:

- Preserve biodiversity by preventing ecosystem destruction

- Cut greenhouse gas emissions from land‑use changes

- Support human rights, including indigenous peoples’land access

- Improve supply chain accountability via traceability and transparency

- Level the trade playing field for businesses committed to responsible sourcing

List of Products Applicable to EUDR

The regulation applies to both raw materials and certain derived products. Specifically, the following commodities are covered:

- Cattle (beef, leather, hides)

- Cocoa

- Coffee

- Oil Palm (including palm oil)

- Rubber

- Soya

- Wood

Associated products include furniture, chocolate, printed paper, leather goods, and more. The scope is expected to expand over time to include other commodities with significant deforestation risks.

Core Elements of EUDR

The foundation of the EUDR lies in its integrated system of controls and obligations, aimed at preventing deforestation-linked products from entering the EU market. The regulation establishes a high standard of accountability, backed by technological and procedural mechanisms to ensure traceability, legality, and environmental compliance.

1. Due Diligence Obligations

Due diligence under the EUDR imposes rigorous responsibilities on operators—importers, producers, exporters—regarding the supply chains of eight high‑risk commodities and their derived products: cattle, cocoa, coffee, oil palm, rubber, soy, timber, and associated products. Operators must:

- Collect comprehensive information: Including product description, origin country, precise geolocation of production areas (down to the plot level), dates of production or harvest, quantities, and supplier details. This geolocation requirement distinguishes EUDR due diligence from previous frameworks and raises the standard for supply chain transparency.

- Perform risk assessment: Operators evaluate the risk of deforestation, compliance with relevant legislation, and legality in the country of origin. They must consider both past deforestation (post‑31 December 2020) and legal violations—this includes not only environmental laws but also land tenure, customary rights, and recognized indigenous claims.

- Apply risk mitigation measures: If a risk is identified (e.g., ambiguous land rights or unclear documentation), operators must respond, potentially by requiring additional evidence, switching suppliers, undertaking independent audits, or collaborating with stakeholders to resolve issues.

- Submit a due diligence statement: Operators declare that to the best of their knowledge (based on the above steps), the goods are deforestation‑free and produced in compliance with all applicable laws. This statement is formal and legally binding.

This due diligence process is continuous. it must be conducted prior to placing commodities on the EU market and must be repeated whenever suppliers, production areas, or risk assessments change. The rigor and accountability built into these obligations reflect the EU’s determination to eliminate deforestation associated with its consumption footprint.

2. Traceability Requirements

Traceability is equally critical under EUDR. Entities must establish systems that trace commodities from their jurisdiction of origin through each intermediary to the point of import into the EU. Key elements include:

- Geospatial Coordinates: Suppliers must provide accurate geocoordinates pinpointing where the commodity was produced, enabling verification that the land had not been deforested post cut‑off date.

- Supply Chain Mapping: Companies need to map their entire supply chain—each node must be transparent and documented, from producer through processors, traders, and exporters.

- Data Integrity: Records and traceability information must be tamper-evident and verifiable. This often involves digital solutions—such as blockchain—or third-party audit trails.

- Chain of Custody: Clear evidence of chain of custody ensures that deforestation-free produce remains segregated throughout transit and processing.

Traceability enables regulators and stakeholders to hold companies accountable and ensure that assumptions (or greenwashing) do not replace real evidence.

3. Tiered Management Inspections

Enforcement under EUDR operates through a tiered system:

- National competent authorities: Each EU Member State designates one or more bodies responsible for verifying compliance with powers to audit documentation, request additional information, and perform physical or geographic inspections of goods in storage, transit, or upon arrival.

- Risk-based inspection strategies: Authorities are required to develop inspection plans based on risk assessments—considering commodity types, origins, operators’compliance history, and identified high‑risk supply chains. This allows them to allocate resources effectively.

- Graduated enforcement responses: Authorities may issue warnings, suspend or withdraw operations, seize goods, or impose financial penalties proportional to the severity of non‑compliance. They also may require corrective actions or temporary halts in trade until compliance is proven.

- Cooperation among Member States: Due to cross‑border trade flows, authorities share intelligence and coordinate inspections to ensure that non‑compliant goods cannot be diverted from one Member State to another undetected.

This tiered management approach ensures that enforcement is both consistent and proportional, leveraging risk intelligence to target the highest‑impact cases while maintaining uniform standards across the EU.

4. Information System Development

To support transparency and compliance, the EU is building a centralized Information System—a digital platform where operators must upload their due diligence statements before placing products on the EU market or exporting them.

The system will include:

- Operator registration,

- Upload interfaces for due diligence documentation,

- Traceability and origin data fields,

- Real-time access for enforcement agencies.

The system officially went live in December 2024, with a transitional period for onboarding and testing.

Starting from December 30, 2025, submission to this information system will become a mandatory precondition for legal market entry.

This mechanism facilitates cross-border coordination, reduces fraud, and supports harmonized enforcement across Member States.

Key Requirements of EUDR for Businesses

Operators under the EUDR must meet three fundamental business obligations: Due Diligence (outlined above), Information Disclosure, and acceptance of Penalties for Violations. These requirements are designed to ensure clarity, accountability, and deterrence.

Due Diligence

This section reframes and deepens the business-critical actions operators must carry out:

Due diligence is non-negotiable. Operators must:

- Establish internal systems (policies, standard operating procedures) to implement due diligence consistently.

- Maintain accurate and verifiable records, retrievable for audits over a specified retention period (likely several years).

- Internal accountability: Assign responsible personnel, conduct regular training, and audit internal compliance to catch and correct procedural gaps.

- Proactively engage with suppliers. Requiring documentation, conducting inspections, or providing capacity building to ensure upstream compliance.

- Be prepared to block trade or terminate relationships if suppliers fail to meet compliance thresholds.

Due diligence is not a one-off requirement; it is a business process embedded into operations and culture.

Information Disclosure

Information disclosure serves both compliance and transparency:

- Operators must furnish precise and accurate information about product origin, processing, supply chain actors, and conformity with legal and deforestation‑free criteria.

- In public communications, such as product labeling or corporate reporting—operators must avoid misleading claims, exaggeration, or misrepresentation. Terms like “deforestation‑free” must be substantiated by documented due diligence.

- Public agencies (and potentially civil society observers) may, over time, receive aggregated or anonymized insights allowing them to assess systemic compliance.

- Companies may integrate EUDR data into sustainability reports or push transparency to reassure consumers, investors, or partners. While strictly avoiding defamation or unverified claims.

Careful and accurate information disclosure is vital—not only does it ensure legal compliance, it also protects reputation and fosters stakeholder trust.

Penalties for Violations

The EUDR imposes robust sanctions for non-compliance, designed to be both deterrent and corrective:

- Financial penalties: Member States must establish fines proportionate to the scale and gravity of the infringement. The regulation encourages a calculation method that considers the value of the goods, economic advantage gained, and duration of violation.

- Confiscation: Non-compliant goods may be seized and destroyed or otherwise disposed of in a manner that avoids stimulating further deforestation-linked demand.

- Suspension of operations: Operators may be barred from trading regulated commodities until compliance is restored and verified.

- Public enforcement records: Repeated or egregious violations may result in reputational damage if enforcement details become public.

- Cross-border repercussions: Sanctions enforced by one Member State inform the status of an operator EU-wide; operators cannot evade accountability by shifting trade flows within the bloc.

Soft enforcement (warnings, corrective action) may apply to first-time, minor breaches; however, willful or repeated non-compliance triggers severe and escalating consequences.

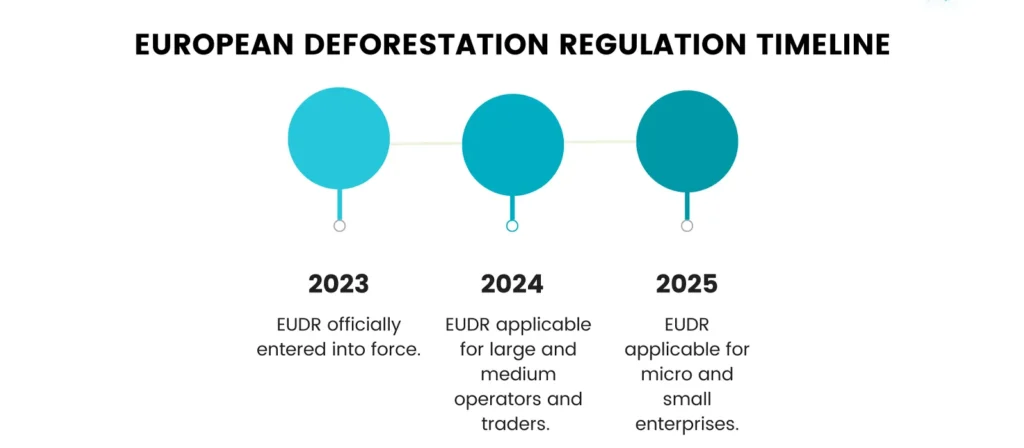

EUDR Timeline

A clear understanding of the regulatory timeline is essential for businesses to plan and prioritize compliance. Key dates under EUDR include:

Regulation Adoption

- The EUDR was formally adopted by the European Parliament and the Council in 2023. The Regulation entered into force on 29 June 2023.

Transitional Phase

- A transitional period extended from mid‑2023 until the end of 2024, allowing businesses time to establish systems, collect geodata, train staff, and adapt supply chains.

Full Compliance Deadlines

- From 30 December 2024: Large operators—typically defined as businesses exceeding certain thresholds (in revenue, trade volume, or workforce)—must fully comply with due diligence, traceability, and reporting obligations.

- From 30 June 2025: Small and micro-enterprises (SMEs) gain additional time to meet compliance requirements. This recognizes limited resources and the need for proportional implementation.

Post‑Compliance Monitoring

- From mid‑2025 onward: National authorities shift from supportive transition toward full enforcement.

- Authorities begin routine inspections, risk-based audits, and triggering of enforcement actions if non-compliance is detected.

Future Review and Expansion

- The European Commission is expected to periodically review the EUDR—for example, to determine whether additional commodities should be added to the scope, or whether risk rating criteria should be adjusted.

- Future updates may expand digital infrastructure, integrate new data sources (e.g., blockchain tracking), or align with evolving international deforestation agreements.

This timeline highlights a phased approach: adoption in 2023, preparatory period, full compliance for large operators by end‑2024, inclusion of SMEs by mid‑2025, followed by enforcement and iterative improvement.

Challenges Faced by Businesses in Complying with EUDR

The implementation of the EU Deforestation Regulation (EUDR) presents a multifaceted compliance challenge for businesses across sectors and geographies. From traceability barriers to technological gaps and legal uncertainties, companies must navigate a new and complex regulatory environment. Below are the principal categories of challenges companies are confronting.

Complex Supply Chains

Many businesses operate through multi-tiered global supply chains that involve multiple producers, traders, intermediaries, and processors. In industries like cocoa, coffee, rubber, and palm oil, traceability to the farm or plot level is often extremely difficult due to:

- Fragmented sourcing from smallholder farmers.

- Informal supply networks without digital recordkeeping.

- Mixing of products at collection or processing points.

Ensuring traceability back to a specific plot of land requires significant restructuring of procurement systems and may necessitate re-contracting with upstream suppliers under new terms.

Lack of Geolocation Data and Digital Infrastructure

One of the most demanding compliance requirements under EUDR is the mandatory submission of geolocation coordinates for every batch of regulated commodities. This implies:

- Deployment of satellite-enabled data capture tools.

- Use of GPS devices during field verification.

- Integration of geospatial data into internal compliance platforms.

In many source countries, especially in tropical regions, neither producers nor local authorities have the necessary digital infrastructure to consistently generate or verify such data.

Legal Ambiguities in Producer Countries

Many of the countries supplying high-risk commodities to the EU suffer from ambiguous, overlapping, or weakly enforced land laws. For example:

- Customary land rights may not be recognized by national authorities.

- Land titles may be missing, disputed, or forged.

- Environmental laws may conflict with agricultural concessions.

As a result, verifying “legal production” under EUDR becomes legally and operationally complex. Businesses must often rely on legal interpretation, third-party audits, and even legal risk insurance to navigate this terrain.

Resource Constraints for SMEs

While the EUDR does provide extended compliance timelines for small and medium-sized enterprises (SMEs), the burden remains significant. Challenges include:

- Limited technical capacity to gather geolocation data.

- Lack of personnel trained in environmental due diligence.

- Higher relative costs for legal consulting, auditing, or digital upgrades.

SMEs involved in exporting or importing EUDR-regulated commodities may require support from trade associations, NGOs, or EU-funded capacity-building programs to achieve compliance.

Risk of Trade Disruption and Supplier Drop-Off

Some companies may respond to the EUDR by exiting high-risk sourcing regions, resulting in de-risking rather than engagement. This carries the risk of:

- Reducing income for smallholder farmers in developing countries.

- Creating perverse incentives that shift deforestation-linked products to other less-regulated markets.

- Weakening incentives for on-the-ground improvements in sustainability.

Therefore, the EUDR must be paired with inclusive implementation tools that support producers—particularly in the Global South.

Penalties for Violations of EU Dispute Settlement Rules

Beyond the core obligations of the EUDR itself, businesses operating within the EU or trading with the EU are subject to a wider set of rules, including compliance with EU dispute settlement frameworks and trade laws. Violations of dispute settlement rules related to deforestation regulation or broader environmental obligations can result in significant consequences.

Administrative Penalties and Trade Sanctions

If a business or country fails to adhere to EUDR requirements and attempts to circumvent or contest enforcement through non-compliant means, the EU may impose:

- Trade sanctions: Including import bans, increased inspection frequency, or quotas on offending commodities.

- Withdrawal of trade privileges: For example, under the Generalised Scheme of Preferences (GSP), which grants preferential access to the EU market for developing countries.

- Suspension of bilateral cooperation mechanisms: Especially in areas related to environment, development, or climate funding.

These measures send a clear message: non-compliance has systemic consequences beyond individual operators.

Legal Liability and Litigation Exposure

In cases of willful misconduct or fraudulent reporting under EUDR, businesses may face:

- Civil litigation: From affected stakeholders, competitors, or consumer groups alleging unfair competition, false advertising, or harm caused by illegal sourcing.

- Criminal liability: If authorities determine that there was intent to conceal deforestation or misrepresent legal compliance, especially in the context of illegal logging or land seizure.

- Investor action: Shareholders may initiate claims against company leadership for failing to disclose material regulatory risks, especially if non-compliance results in material financial loss.

Thus, legal compliance must be treated as a fiduciary obligation with governance-level accountability.

Damage to Reputation and Market Access

Perhaps the most significant long-term penalty is reputational harm. EUDR is widely supported by consumers, investors, and civil society. Public exposure of violations may result in:

- Brand damage: Especially for consumer-facing companies in the food, fashion, and retail sectors.

- Investor divestment: ESG-focused investment funds are unlikely to retain shares in non-compliant businesses.

- Loss of B2B partnerships: If a supplier poses a threat, large companies may remove it from their supplier list.

Compliance is not just a legal formality—it is a prerequisite for maintaining credibility in global markets.

Conclusion

The EU Deforestation Regulation marks a strategic turning point in the global fight against deforestation. By mandating robust due diligence, pinpoint traceability, tiered inspections, and a centralized information system, the EU is setting a new bar for import regulation—one that balances environmental accountability with trade viability.

Businesses must embed due diligence processes at their core, invest in traceability systems, and remain transparent in supply chain disclosures. Enforcement will be rigorous, technology-supported, and continuously refined. Compliance timelines provide a phased pathway, but beginning early is critical.

In doing so, operators not only meet legal requirements but also enhance corporate sustainability, meet stakeholder expectations, and contribute to the preservation of global forests. The EUDR is not merely a regulation—it is a reshaping of market norms toward deforestation-free commerce.